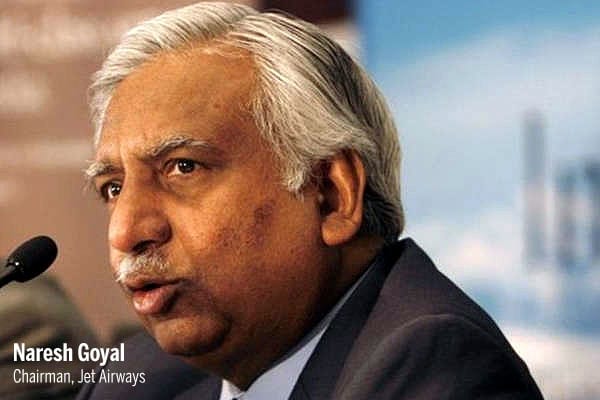

Higher airport charges and taxation shackle airline industry: Naresh Goyal

Raising the issue of increasing airport charges and levies along with high taxation, Jet Airways chairman Naresh Goyal has said such factors continue to “shackle” the airline industry. Goyal, in the airline’s annual report for 2016-17, sent to the shareholders ahead of the company’s AGM next month, also said the existing airport infrastructure has not been able to match with the rapid growth in passenger volumes and aircraft movement. Goyal, however, maintained that the domestic aviation sector remains robust and holds out significant opportunities to the players in the space. “For aviation to truly realise its potential, several areas must be addressed. Escalating airport levies, surcharges and high taxation continue to shackle the industry,” Goyal said.

The current airport infrastructure is unable to keep pace with the breakneck growth in capacity and traffic, he said adding, “Addressing these issues is the most urgent need of the hour.” However, these challenges notwithstanding, the domestic aviation market is set for a bright future, he added. Goyal also said government’s UDAN scheme will further boost air connectivity across the country.

Significantly, Jet Airways along with some other domestic carriers did not participate in the first round of bidding for operating flights under UDAN scheme. In the first phase, five air operators –Alliance Air, SpiceJet, TruJet, Air Deccan and Air Odisha – bagged the flying rights to operate on 128 routes connecting over 30 underserved airports under the scheme. “I am convinced that the Indian aviation sector remains robust and holds out significant opportunities with political and economic stability, growth in GDP, higher disposable incomes and a young and aspirational population contributing largely to the potential of aviation,” Goyal said in the report.

The Mumbai-based full service carrier will also announce June quarter results next month along with its AGM as it is adopting new accounting standards from this fiscal. “Since the company is adopting the Indian Accounting Standards (Ind AS) from the financial year 2017-18, the company may submit its financial results for the quarter ended June 30, 2017 to the stock exchanges by September 14, 2017,” Jet Airways had said in a regulatory filing earlier this month. Ind AS is converged with the International Financial Reporting Standards (IFRS). Under SEBI regulations, a listed company is required to submit its quarterly financial results to the stock exchanges within 45 days of the end of a quarter. Jet Airways group had reported a net profit of `438 crore for the financial year ended March 31, 2017.